One of the hardest things about managing money is information overload. The endless stream of personal finance calculations, figures, terms, and choices to remember. The overwhelming pile of metrics and numbers may make you want to throw up your hands with managing your money.

But the good news is, most of this stuff isn’t nearly as vital as it pretends to be.

However, life isn’t always about learning more. It’s often about learning less and separating the clutter from what matters. And money is no exception. So that’s what we’re doing today: clearing away some of the stressful money numbers (clutter) that someone may have said you “need” to know.

4 Personal Finance Numbers That Don’t Really Matter

There are two components to improving almost any situation: finding what you can get rid of, simplifying or reducing, and then seeing what’s left that’s worth expanding.

In that spirit, let’s take a trip through some of the personal finance calculations we don’t need. The numbers can distract and overwhelm you rather than encourage and illuminate you. Then, with those out of the way, we’ll be able to double down on a few numbers that make all the difference to a healthy life with money.

1. Interest Rates

There was a time when you could put your money in a savings account and earn money through a magical force called interest. You would put money in a bank, and this interest would grow and compound your money. The better the interest rate, the greater your ever-increasing pile of riches. Magical, yes?

Joking aside, it has been decades since bank accounts offered people meaningful interest payouts. And there’s no sign of them coming back anytime soon. Interest rates today range roughly from “pathetic” to “flat-out insulting.”

A bank account these days won’t make you rich. But it doesn’t need to.

Checking and savings accounts still serve other valuable purposes. And if they manage to pull a few bucks in interest here and there, that’s great. But on the whole, I wouldn’t waste much valuable energy fussing over which account has the ideal interest rate.

2. Debt:Income Ratio

Let’s keep this one brief. If you’re unfamiliar, your debt-to-income ratio is the relationship between how much money you make and how much debt you have.

I could give an equation or examples, but honestly, I’m not going to bother because this number has no useful place among personal finance calculations.

This number implies that some level of debt is acceptable, provided you make enough money. But no matter how much you earn or how little you owe, debt still sucks! There is no crossover point where you should start sweeping your debt under the rug. This line of thinking is a slippery slope to excessive debt.

There is also no level where debt suddenly becomes a problem. Debt of any size drains your finances and offers nothing in return. So getting rid of it should always be a priority, regardless of proportions.

3. Your Credit Score

Credit scores are not your friend.

They are one of the most dangerous personal finance calculations there is. Lenders designed them to encourage you to spend your life in debt. Your credit score measures how good you are at owing money, and it encourages you to owe more money. This is not a blue ribbon anyone should be trying to win.

Make choices and actions that benefit YOU, your money, and your financial future.

A lot of bad money advice gets casually thrown around in the name of credit scores: Take out a credit card you don’t need; don’t buy the car in cash; take out a loan to boost your credit!

This reverent aura around credit scores is a dangerous misconception about debt.There is no need to obsess over these arbitrary bank points. Do not make money decisions you otherwise wouldn’t make just for a credit score boost. Simply living a healthy financial life and paying your bills on time will give you all the credit history you need.

4. Your Average Rate of Return

Okay, so the number we’re talking about here is the rate of return on your past investments. Invest $100 and cash out at $110 — that’s a 10% return. Average these across your various investments and transactions, and you have your individual rate of return.

Unlike the interest rates and others above, this number dramatically impacts wealth-building.

It is good to keep an eye on how your investments are performing. You should know if something gets out of whack and needs adjusting. The problem is obsessing over your performance as an investor like it’s a stat on a baseball card.

Good investing isn’t about being an extraordinary performer. On the contrary, a practically endless body of analysis has shown that low-cost, long-term index investing is the most reliable strategy for most people.

In other words, if you’re investing smartly, your average returns will be nearly identical to the market. So ride the wave because those who try to fight the ocean always lose in the long run.

And if that’s the case, then why waste any time worrying about your personal performance?

3 Personal Finance Calculations That Really DO Matter

One of my main motivations for writing this article is to help you shift the emotional tide of dealing with your finances. So in the first half, we turned away from numbers that create stress, waste energy, and ultimately hold you back on the road to financial freedom. And here we’re doing the opposite.

It’s important to stop worrying about numbers and equations that weigh us down. And it’s just as important to check the personal finance calculations that we can get excited about. So here are three – just three – numbers worth our attention. Over time they will transform your attitude toward money and make a massive impact on your financial health.

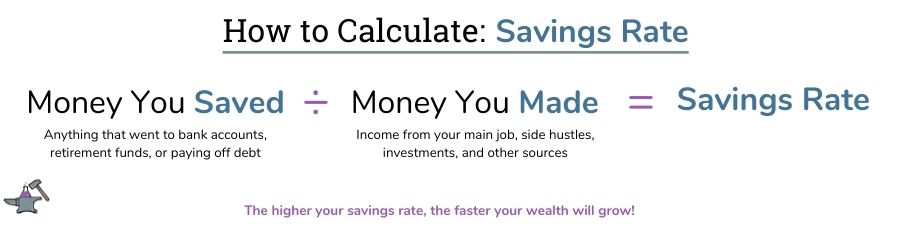

1. Your Savings Rate

How much money you save is the most crucial factor in building wealth. And instead of fixating on any specific dollar amount to save, you will be better off focusing on your savings rate.

Your savings rate is the percentage of your income you do not spend. For example, if you make $500 a month and save $50 of that, your monthly savings rate would be 10%.

Conventional wisdom suggests a savings rate of at least 10-20%. However, so-called extreme savers have been known to shoot for 80% and beyond (it’s more attainable than you may think!) But none of these benchmarks is the be-all and end-all. Bottom line: the higher your savings rate, the more rapidly your financial life will transform.

You may have questions on the details of calculating your individual savings rate, such as:

- Do I include retirement deferrals in my income?

- Are debt payments part of my saving or my spending?

- Is this pre-tax or post-tax income?

- What about donations and gifts?

Any money that enters your life is income. Any income that you use to increase your net worth is savings. And everything that remains is spending.

Don’t sweat the details of the above labels too much. Instead, measure this one in the way that works best for you. Just be consistent with it, and put all your extra energy into growing your savings rate over time!

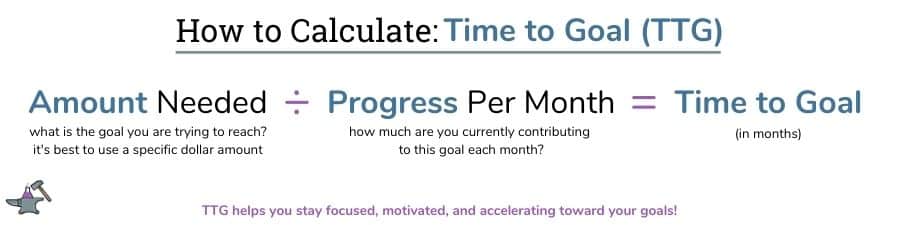

2. Your Time to Goal (TTG)

Okay, here is a fun one. But we have to be quick about it before I get arrested for using the phrase “here is a fun one” in an article about personal finance calculations.

One number I love checking, which you can also use to give you some excitement and motivation, is your time to goal, or TTG as I’m going to call it (three-letter initialisms make things sound more official, I’ve done a lot of science on this).

What is your next big financial goal? Do you want to buy a house? Pay off the car? Spend three months backpacking through southeast Asia? See some Incan ruins? Give that goal a financial number (A) to know your target.

How much are you contributing to that goal per month (B)? Divide A by B, and you have an estimate of how long it will take you to reach that goal. In other words, your TTG. Get excited about this number, watch it tick downward, start a countdown on your calendar, paint it on your forehead, and see if you can shrink it even faster!

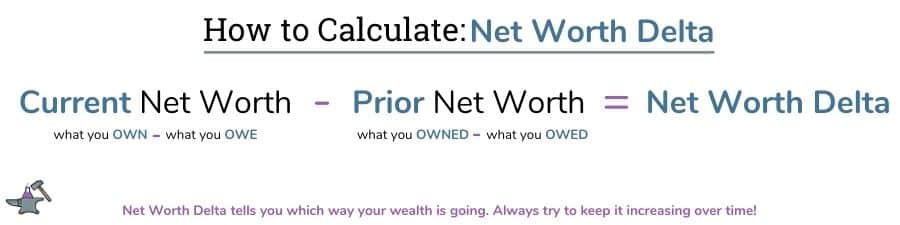

3. Net Worth Delta

You’ve probably heard somebody brag about their net worth or rave about a celebrity’s estimated net worth. Maybe you’ve even calculated your own and compared yourself to said celebrity to see how you measure up.

Net worth on its own is something we focus on way too much. Knowing where you stand and how you’re progressing can be helpful. But similarly to the rates of return discussed in the first half above, tying your self-worth to financial performance is problematic.

But there’s a third word here: delta, as in difference or change. Think journey, not destination.

Forget about what you think your net worth should be or could be or what anyone else’s is. All you need to know is that you’re moving the needle in the right direction. Instead of worrying about how much money you have right now, it’s better to ensure that it’s increasing over time.

Calculating net worth delta is pretty simple. First, add up the value of everything you own (cash, bank accounts, investments, and property all in one soup) and subtract everything you owe (loans, credit cards, etc.). This number is net worth.

From there, you only need to subtract last month’s net worth from this month’s. Yearly works, too. The result is your net worth delta: how much your wealth has changed over that period. If it is positive, your net worth has increased. If it is negative, your net worth has decreased. In either case, the long-term goal is to keep bringing up that delta so that you can grow faster and faster!

Simple Finances are Healthy Finances

While some financial advisors and Wall Street suits and that guy Brad from payroll all shout at you about metrics, formulas, rates, and other complicated financial numbers, you can wave them off and set your attention to things that will make a difference. When it comes to your finances, these three are a good place to start:

- How much of your monthly income you can keep (savings rate)

- How long it will take you to reach your next exciting financial milestone (time to goal)

- How much you are increasing or decreasing your wealth over time (net worth delta)

I think this article is especially important for folks like myself, who were raised in the “bank savings account/interest” era. It’s been very challenging to adapt to other ways of thinking about finances; but imperative that we do. Thanks for your insight.